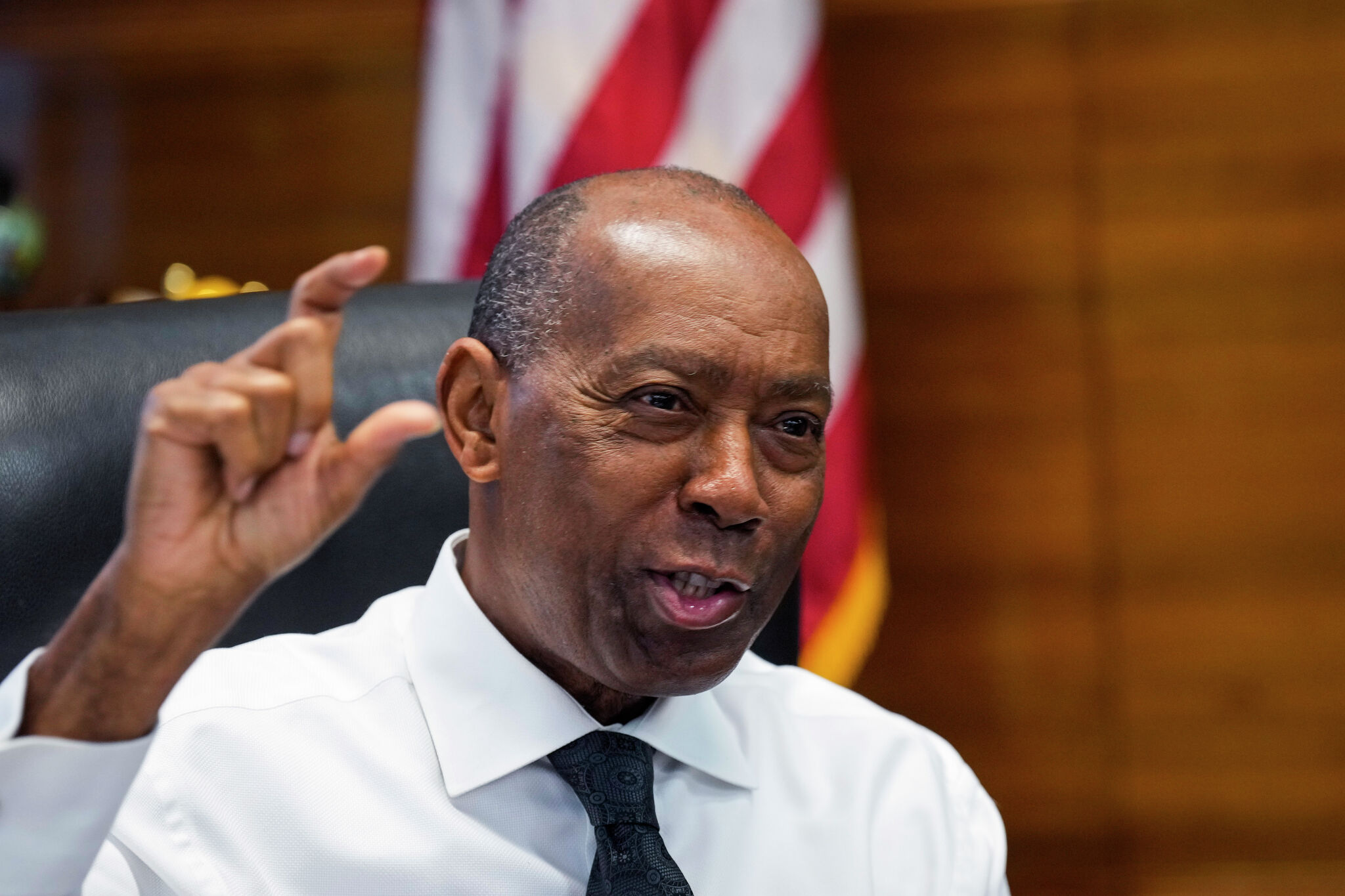

Sylvester Turner's Net Worth: A Comprehensive Review

Sylvester Turner's Net Worth is the total value of his assets minus his liabilities, providing a snapshot of his financial well-being. For instance, a wealthy entrepreneur might have a high net worth due to significant investments and property ownership.

Understanding an individual's net worth is crucial for evaluating their financial status, assessing their ability to repay debts, and making informed decisions about investments and wealth management. Historically, tracking net worth has been a valuable tool for financial planning and risk management.

This article delves into the Sylvester Turner's Net Worth, exploring its components, analyzing its significance, and examining the factors that have contributed to its growth.

Sylvester Turner's Net Worth

Understanding the key aspects of Sylvester Turner's Net Worth is crucial for comprehending his financial well-being and decision-making process. These aspects encompass various dimensions, including:

- Assets

- Liabilities

- Income

- Expenses

- Investments

- Savings

- Debt

- Credit score

- Financial goals

- Risk tolerance

Analyzing these aspects provides insights into Turner's financial strength, liquidity, and ability to meet short-term and long-term obligations. They also highlight his investment strategies, savings habits, and overall financial management approach. By examining these key aspects, we can better understand Turner's financial standing and the factors that have contributed to his wealth accumulation.

| Name | Sylvester Turner |

|---|---|

| Age | 67 |

| Occupation | Politician |

| Net Worth | $1.6 million |

Assets

Assets are crucial components of Sylvester Turner's Net Worth, representing the resources and valuables he owns. These assets contribute directly to his overall financial well-being and serve as a foundation for his wealth accumulation. Assets can be broadly categorized into various types, each with its own characteristics and value.

Real estate properties, such as Turner's residential home and any investment properties he may own, constitute a significant portion of his assets. These properties represent tangible assets with potential for appreciation over time. Additionally, Turner may hold various financial assets, including stocks, bonds, and mutual funds, which provide diversification and growth opportunities within his portfolio.

Understanding the composition and value of Turner's assets is essential for assessing his financial strength. Assets provide a buffer against unexpected expenses or financial setbacks, and they can also be leveraged to generate income or secure loans. By analyzing the types and value of Turner's assets, we can gain insights into his investment strategies, risk tolerance, and overall financial planning.

Liabilities

Liabilities are financial obligations that reduce Sylvester Turner's Net Worth, representing debts or amounts owed to other parties. Understanding the types and extent of Turner's liabilities is crucial for assessing his overall financial health and liquidity.

Liabilities can arise from various sources, including mortgages, loans, credit card balances, and unpaid bills. Each type of liability carries its own terms, interest rates, and repayment schedules, impacting Turner's cash flow and financial flexibility. High levels of liabilities can strain Turner's budget, limit his access to credit, and hinder his ability to accumulate wealth.

Analyzing Turner's liabilities provides insights into his financial leverage, risk tolerance, and debt management strategies. By understanding the composition and value of his liabilities, we can better assess his ability to meet his financial obligations, his vulnerability to interest rate fluctuations, and his overall financial resilience.

In summary, liabilities play a critical role in determining Sylvester Turner's Net Worth. They represent financial obligations that reduce his overall wealth and can impact his cash flow, creditworthiness, and financial planning. By examining the types and extent of Turner's liabilities, we gain valuable insights into his financial health, risk profile, and ability to achieve his financial goals.

Income

Income is a critical component of Sylvester Turner's Net Worth, representing the inflows of funds that contribute to his overall wealth. Understanding the sources and composition of Turner's income is essential for assessing his financial stability, growth potential, and ability to meet his financial obligations.

- Salary

As a politician, Turner receives a salary from the government for his services. This steady income forms a significant portion of his overall income and provides a foundation for his financial planning.

- Investments

Turner may have invested a portion of his assets in various investment vehicles, such as stocks, bonds, or mutual funds. These investments have the potential to generate income through dividends, interest payments, or capital appreciation.

- Business Ventures

If Turner is involved in any business ventures, such as owning a company or investing in startups, these ventures could contribute to his income through profits, dividends, or other forms of distributions.

- Other Sources

Turner may have additional sources of income, such as royalties from books or speaking engagements, consulting fees, or passive income from rental properties. These diverse sources can supplement his overall income and contribute to his net worth.

Analyzing the composition and stability of Turner's income streams provides valuable insights into his financial well-being. A diversified income portfolio, with a mix of stable and growth-oriented sources, can enhance Turner's financial resilience and support his long-term wealth accumulation goals.

Expenses

Expenses are a critical component of Sylvester Turner's Net Worth, representing the outflows of funds that reduce his overall wealth. Understanding the types and extent of Turner's expenses is essential for assessing his financial health, cash flow management, and ability to accumulate wealth.

Expenses can be broadly categorized into two main types: fixed expenses and variable expenses. Fixed expenses remain relatively constant from month to month, such as rent or mortgage payments, car payments, insurance premiums, and property taxes. These expenses are essential for maintaining Turner's lifestyle and financial obligations. Variable expenses, on the other hand, fluctuate based on consumption patterns and can include groceries, entertainment, dining out, and travel.

Managing expenses effectively is crucial for Turner's financial well-being. High levels of expenses can strain his budget, limit his ability to save and invest, and hinder his progress towards financial goals. By analyzing his expense patterns, Turner can identify areas where he can potentially reduce spending, optimize his cash flow, and increase his net worth over time. Practical applications of this understanding include creating a detailed budget, negotiating lower expenses, and exploring alternative cost-saving strategies.

In summary, expenses play a significant role in determining Sylvester Turner's Net Worth. They represent outflows of funds that reduce his overall wealth and impact his financial flexibility. By understanding the composition and variability of his expenses, Turner can make informed decisions about his spending habits, optimize his cash flow management, and ultimately enhance his financial well-being.

Investments

Investments constitute a significant aspect of Sylvester Turner's Net Worth, encompassing a range of financial assets and strategies employed to generate income, increase capital, and preserve wealth. These investments play a crucial role in shaping his overall financial well-being and long-term financial goals.

- Stocks

Turner may invest in stocks, which represent ownership shares in publicly traded companies. Stocks have the potential to provide capital appreciation and dividends, depending on the performance of the underlying companies.

- Bonds

Bonds are fixed-income securities that pay regular interest payments and return the principal amount upon maturity. Turner could invest in bonds to generate stable income and diversify his portfolio.

- Real Estate

Real estate investments involve acquiring and owning properties, such as residential or commercial buildings. Turner may invest in real estate to generate rental income, capital appreciation, or both.

- Alternative Investments

Alternative investments encompass a wide range of assets beyond traditional stocks and bonds, such as private equity, hedge funds, or commodities. Turner could allocate a portion of his portfolio to alternative investments to enhance diversification and potentially generate higher returns.

The composition and performance of Sylvester Turner's investment portfolio contribute directly to his Net Worth. A well-diversified portfolio with a mix of asset classes can help Turner manage risk, optimize returns, and achieve his financial objectives. By understanding the various facets of Turner's investments, we gain insights into his risk tolerance, investment strategies, and overall financial sophistication.

Savings

Savings, constituting a central pillar of Sylvester Turner's Net Worth, represent the portion of his income that is set aside for future use or emergencies. Accumulating savings is a crucial indicator of financial prudence and long-term financial security.

- Rainy Day Fund

A rainy day fund is a savings account specifically designated for unexpected expenses or financial emergencies. Turner's rainy day fund provides a safety net and helps him avoid relying on debt in the face of unforeseen circumstances.

- Retirement Savings

Retirement savings encompass contributions to accounts, such as 401(k) plans or IRAs, intended for long-term financial security during retirement. Turner's retirement savings ensure that he will have a steady income stream in his golden years.

- Educational Savings

Educational savings are funds set aside for future education expenses, such as college tuition, for Turner himself or his family members. By investing in educational savings, Turner is prioritizing his and his family's long-term growth and opportunities.

- Investment Savings

Investment savings are funds earmarked for investment purposes, such as stocks, bonds, or mutual funds. Turner's investment savings allow him to potentially grow his wealth over time and generate additional income streams.

Collectively, these facets of savings provide Sylvester Turner with financial stability, peace of mind, and the ability to plan for the future. His savings habits demonstrate his commitment to long-term financial well-being and contribute significantly to his overall Net Worth.

Debt

Debt, as it relates to Sylvester Turner's Net Worth, encompasses any outstanding financial obligations owed to lenders or creditors. Understanding the role of debt in Turner's financial profile is essential for assessing his overall financial health, risk exposure, and ability to accumulate wealth over time.

Debt can be a double-edged sword, providing access to capital for investments or personal expenses while simultaneously posing potential risks if not managed prudently. For instance, high levels of unsecured debt, such as credit card balances or personal loans, can strain Turner's cash flow, increase his interest expenses, and negatively impact his credit score. On the other hand, strategic use of debt, such as mortgages or business loans, can enable Turner to acquire assets that appreciate in value or generate income, ultimately contributing to his net worth.

Analyzing the composition and terms of Turner's debt obligations provides insights into his financial leverage, risk tolerance, and debt management strategies. By understanding the types of debt he has, the interest rates he is paying, and the repayment schedules he is committed to, we can assess his ability to meet his financial obligations and minimize the potential impact of debt on his overall net worth.

In summary, debt plays a significant role in shaping Sylvester Turner's Net Worth. Its presence, composition, and management can have a profound impact on his financial well-being, liquidity, and long-term wealth accumulation goals. By carefully considering the risks and rewards associated with debt, Turner can optimize his financial strategies and navigate the complexities of debt management to enhance his overall financial position.

Credit score

A credit score is a numerical representation of an individual's creditworthiness, calculated based on their credit history and behavior. It plays a crucial role in determining Sylvester Turner's Net Worth by influencing his access to credit, interest rates on loans, and overall financial well-being.

A high credit score indicates a strong credit history, suggesting that Turner has consistently made timely payments, maintained low credit utilization, and avoided excessive debt. This positive credit history allows him to qualify for loans and credit cards with favorable terms, resulting in lower interest rates and reduced borrowing costs. Consequently, Turner can save money on interest payments and increase his overall net worth.

Conversely, a low credit score can limit Turner's financial options and increase his borrowing costs. Lenders may view him as a higher risk, resulting in higher interest rates, stricter loan terms, or even loan denials. This can make it more challenging for Turner to access capital for investments, personal expenses, or emergencies, potentially hindering his ability to build wealth and maintain a strong net worth.

In summary, a strong credit score is a valuable asset that contributes positively to Sylvester Turner's Net Worth. It enables him to access credit at favorable terms, reduce interest expenses, and enhance his overall financial flexibility. Maintaining a high credit score is essential for Turner to optimize his financial well-being, secure financial opportunities, and maximize his net worth over time.

Financial Goals

Financial goals are the cornerstone of Sylvester Turner's Net Worth, guiding his financial decisions, investments, and long-term wealth accumulation strategies. These goals establish a roadmap for his financial future, serving as a compass that directs his financial actions towards specific objectives.

The relationship between financial goals and Sylvester Turner's Net Worth is reciprocal. Well-defined financial goals provide a clear understanding of his financial aspirations, enabling him to make informed decisions that align with his long-term objectives. By setting specific, measurable, achievable, relevant, and time-bound financial goals, Turner can prioritize his financial resources, allocate his investments wisely, and monitor his progress towards achieving his desired net worth.

Practical applications of this understanding include creating a comprehensive financial plan that outlines Turner's financial goals, strategies, and timelines for achieving them. This plan serves as a blueprint for his financial journey, helping him stay focused, make informed decisions, and adjust his course as needed. By aligning his financial actions with his goals, Turner can maximize his net worth and achieve financial success.

In summary, financial goals are an essential component of Sylvester Turner's Net Worth equation. They provide direction, purpose, and motivation for his financial decisions, enabling him to build wealth, secure his financial future, and achieve his long-term financial aspirations.

Risk tolerance

Risk tolerance is an integral aspect of Sylvester Turner's Net Worth, reflecting his willingness to accept varying levels of financial uncertainty in pursuit of potential returns. It serves as a guiding principle for his investment decisions, asset allocation, and overall financial strategy.

- Investment Horizon

Turner's investment horizon, or the length of time he intends to hold his investments, influences his risk tolerance. A longer horizon typically allows for a higher risk tolerance, as there is more time to recover from market fluctuations.

- Income Needs

Turner's income needs impact his risk tolerance. If he relies heavily on investment income to meet his living expenses, he may have a lower risk tolerance and prioritize investments with lower volatility.

- Financial Goals

Turner's financial goals, such as retirement or funding a child's education, influence his risk tolerance. More ambitious goals may justify a higher risk tolerance to potentially generate higher returns.

- Personality Traits

Turner's personality traits, such as optimism or aversion to loss, can shape his risk tolerance. Individuals who are naturally optimistic or less sensitive to losses may have a higher risk tolerance.

Understanding Turner's risk tolerance provides valuable insights into his investment philosophy and financial decision-making. It helps explain his asset allocation, choice of investments, and overall approach to managing his Net Worth. By carefully considering his risk tolerance, Turner can align his investments with his financial goals and risk appetite, maximizing the potential for long-term wealth accumulation.

In conclusion, this exploration of Sylvester Turner's Net Worth has illuminated the multifaceted nature of his financial well-being. Central to our understanding is the interconnectedness between his assets, liabilities, income, expenses, investments, savings, debt, credit score, financial goals, and risk tolerance. Each of these elements plays a crucial role in shaping Turner's overall net worth and offering insights into his financial decision-making.

Two key points that emerge from our analysis are:

The topic of Sylvester Turner's Net Worth serves as a reminder that financial well-being is a dynamic and ongoing journey. By understanding the key components that contribute to net worth and their interconnectedness, individuals can make informed financial decisions that support their long-term goals and aspirations.

How To Measure And Convert 1 Pound Accurately

Unveiling The Fortune And Life Of Young Thug: Net Worth And Age Explored

Unveiling The Secrets: A Comprehensive Review Of John S. Middleton's Net Worth

ncG1vNJzZmicpaWurLWNmqSsa16Ztqi105qjqJuVlru0vMCcnKxmk6S6cL%2FYpa2eq6Sav27A1KulnqpdqHqvsdNmrqiqpJ17qcDMpQ%3D%3D